The Trading Journal to Trade Better

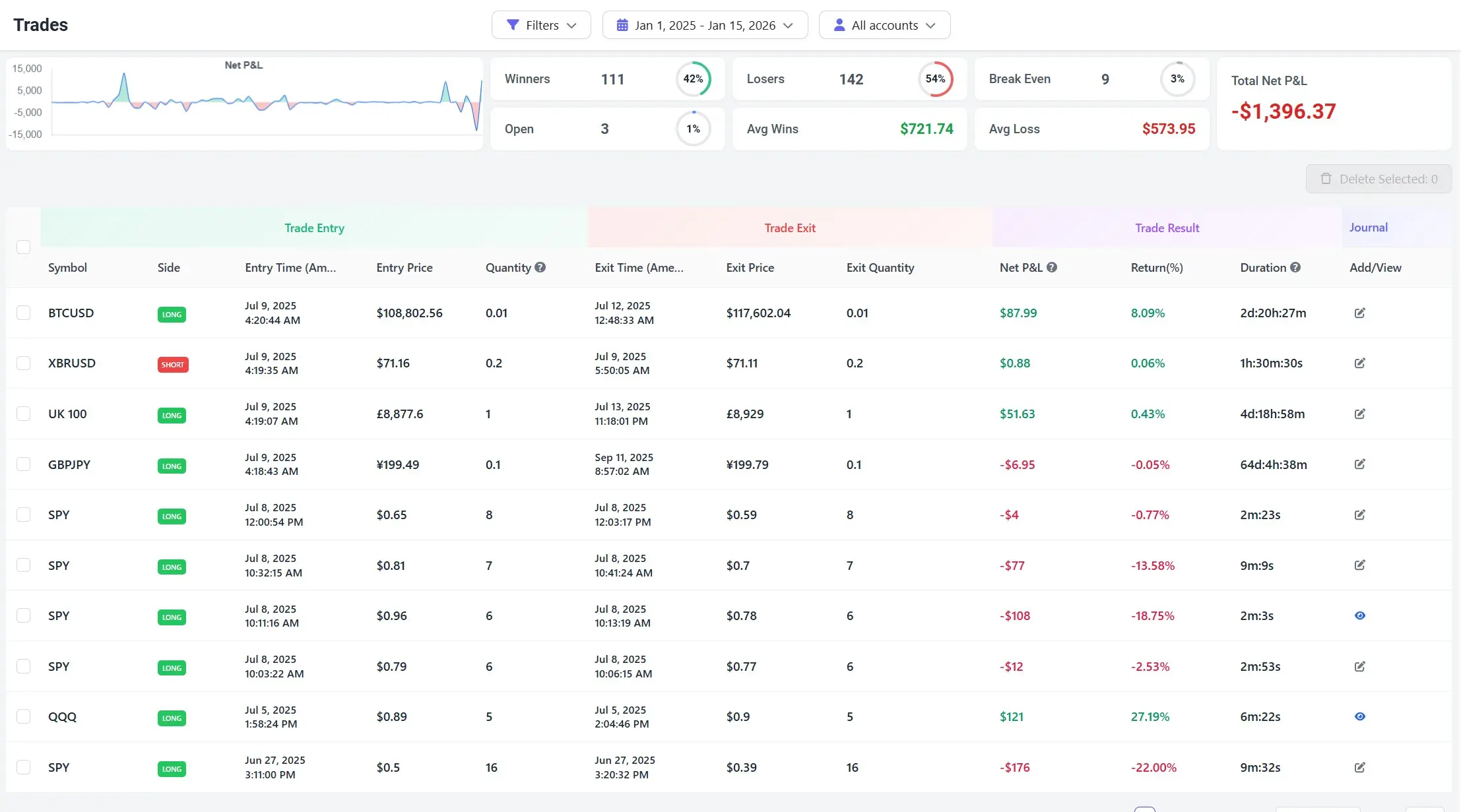

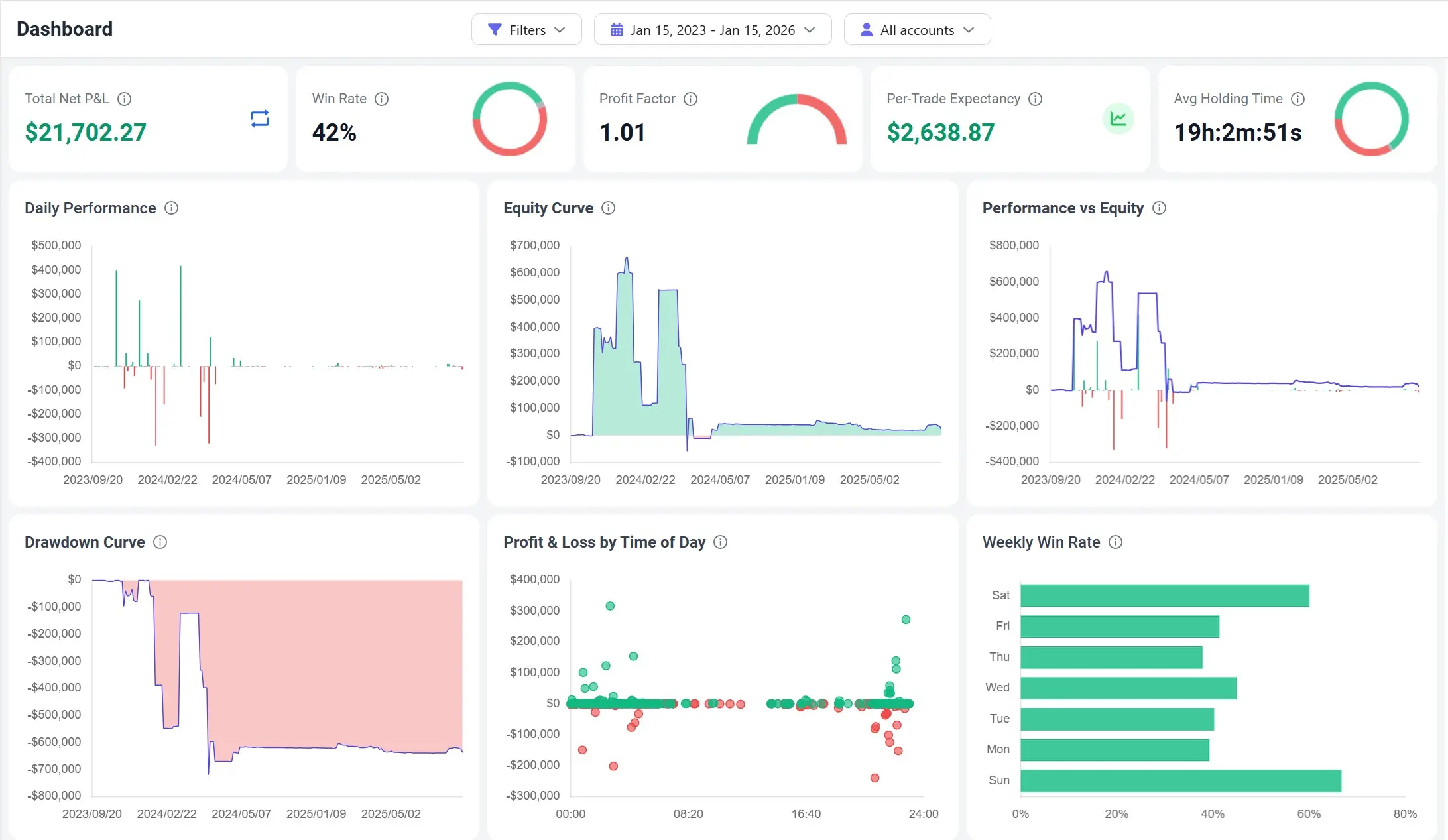

A trading journal for better decisions. Import trades, review performance, and capture the why behind every trade, all in one place.

Automate your trading journal

Trade log built for analysis

Stop guessing. Start analyzing.

Build a routine that actually sticks

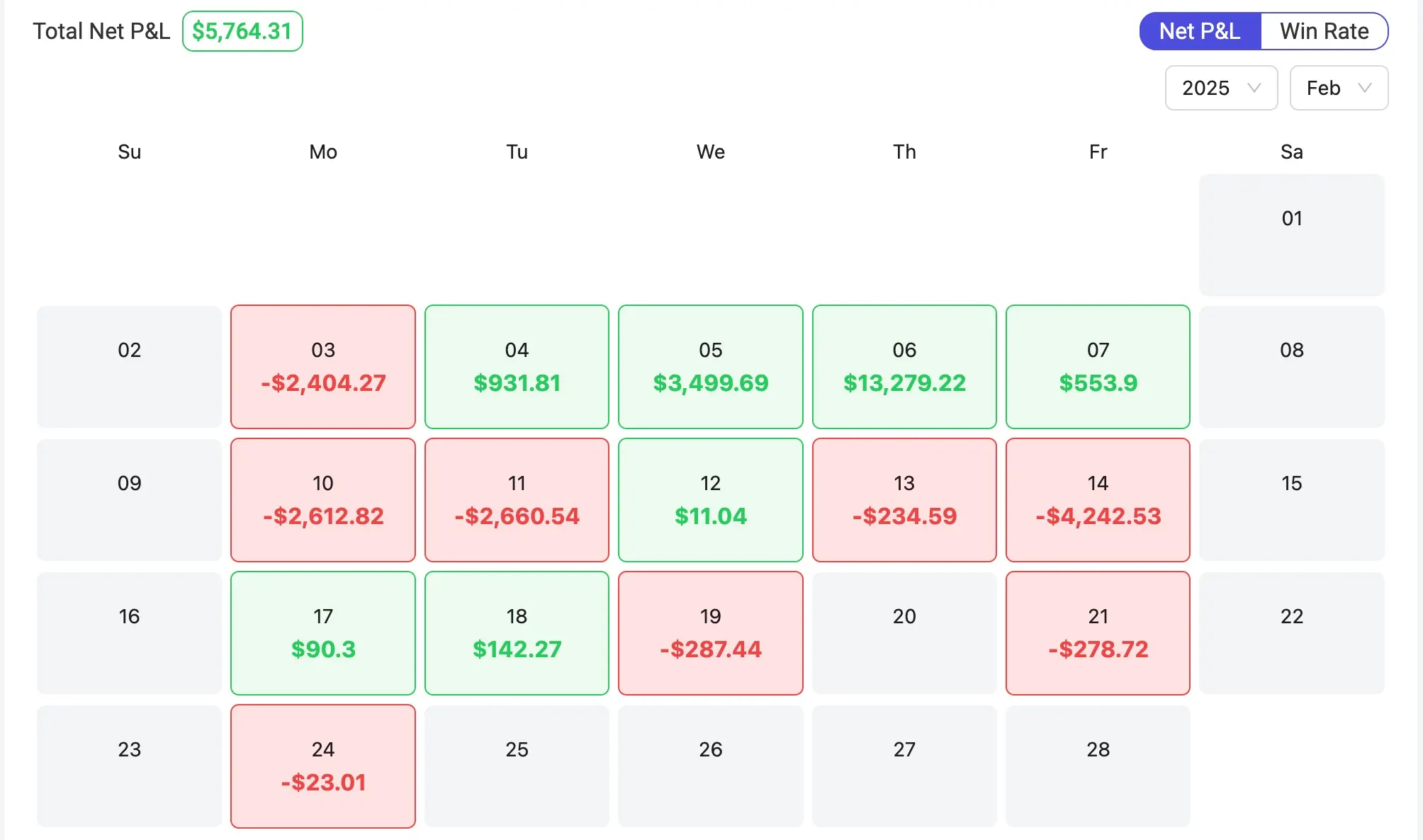

See monthly performance at a glance

A calendar view that highlights streaks, red days, and turning points.

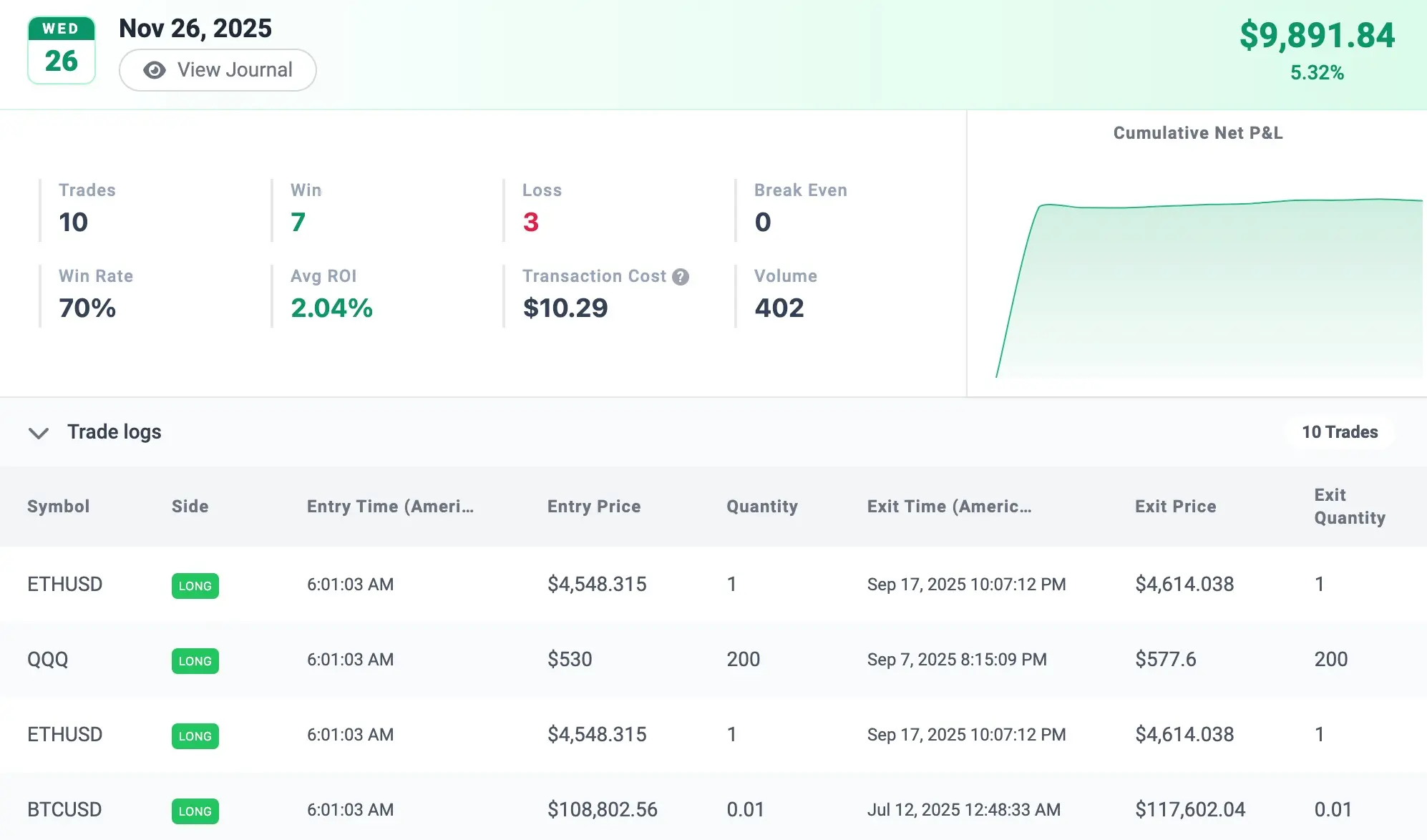

Review any day fast

Open a day to see the summary and the trades behind it.

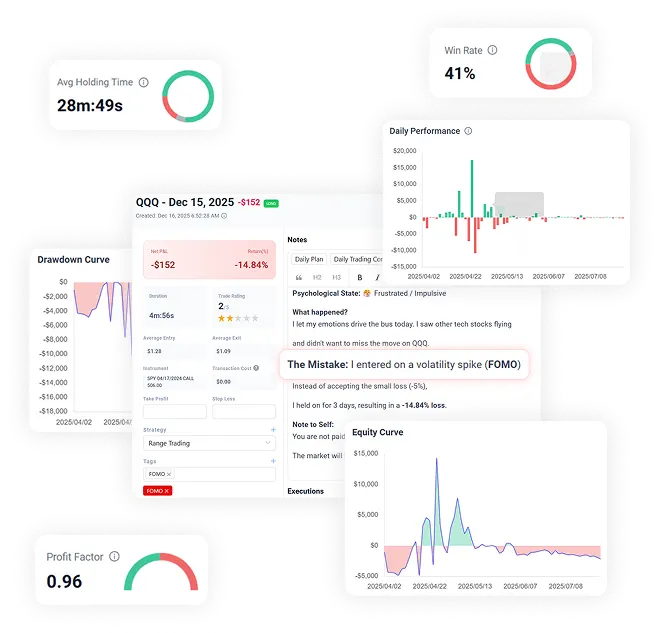

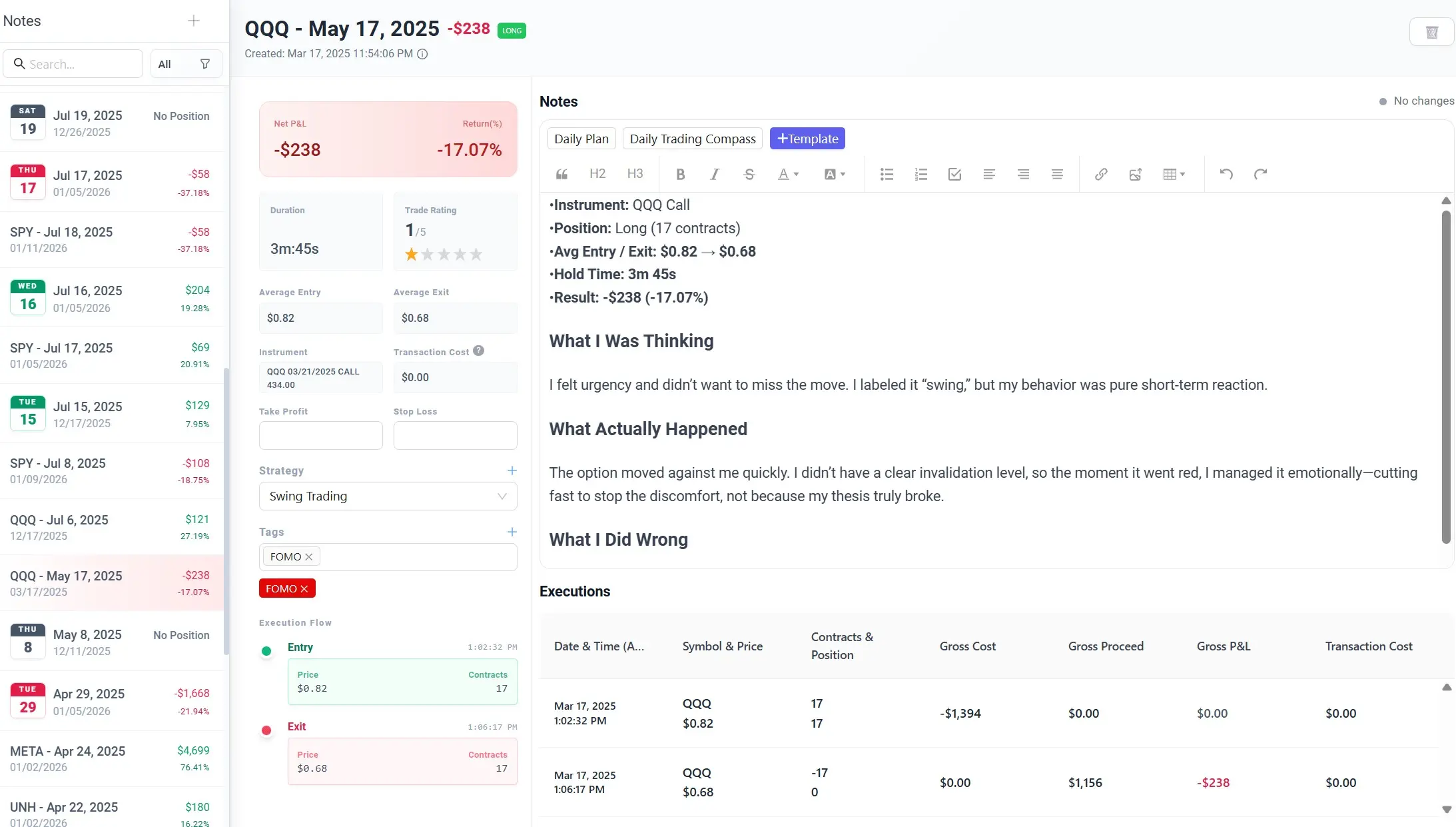

Track the why, not just the what

Find what works. Fix what doesn’t.

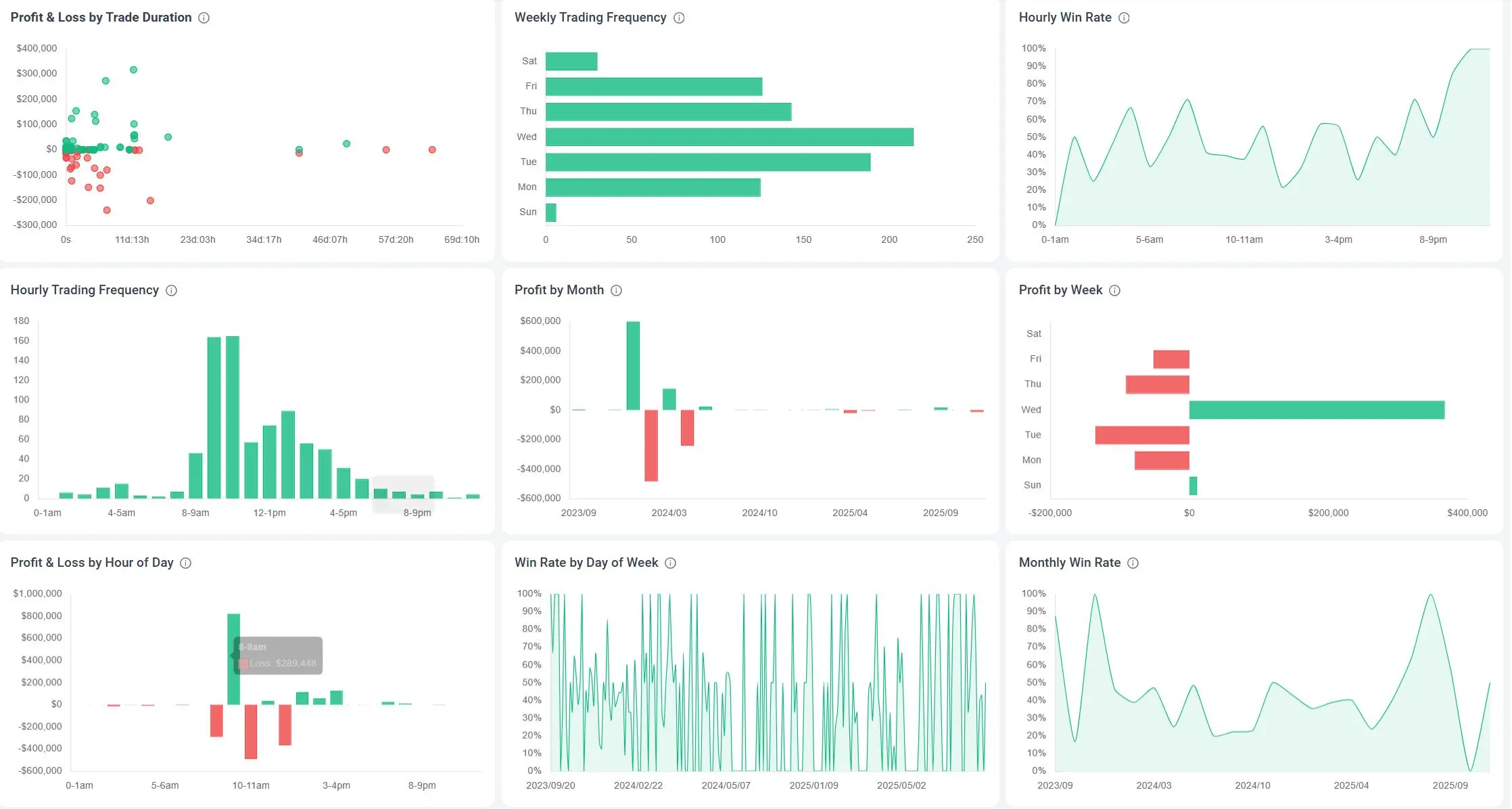

Trade better by time of day

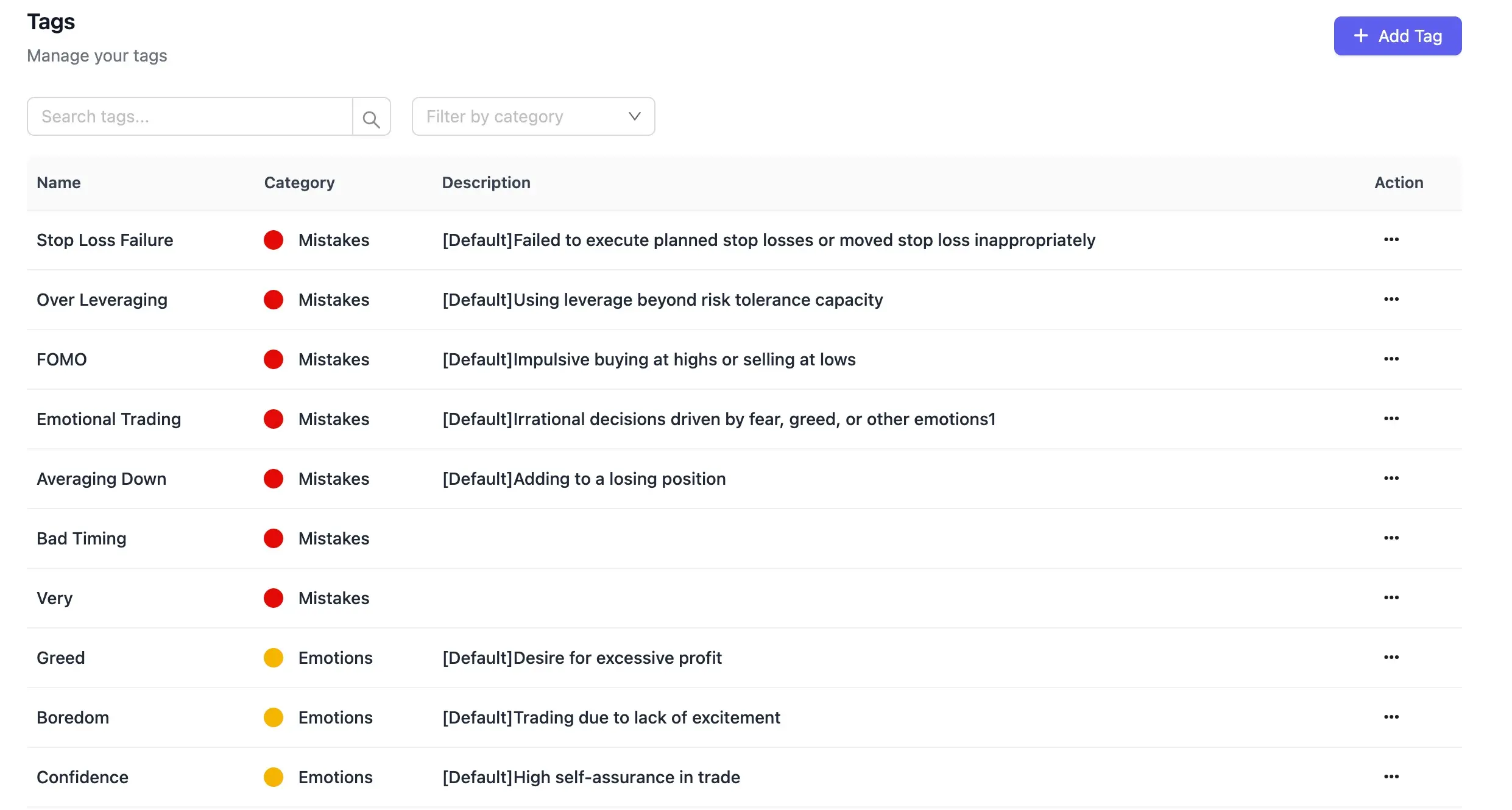

Tag repeat mistakes

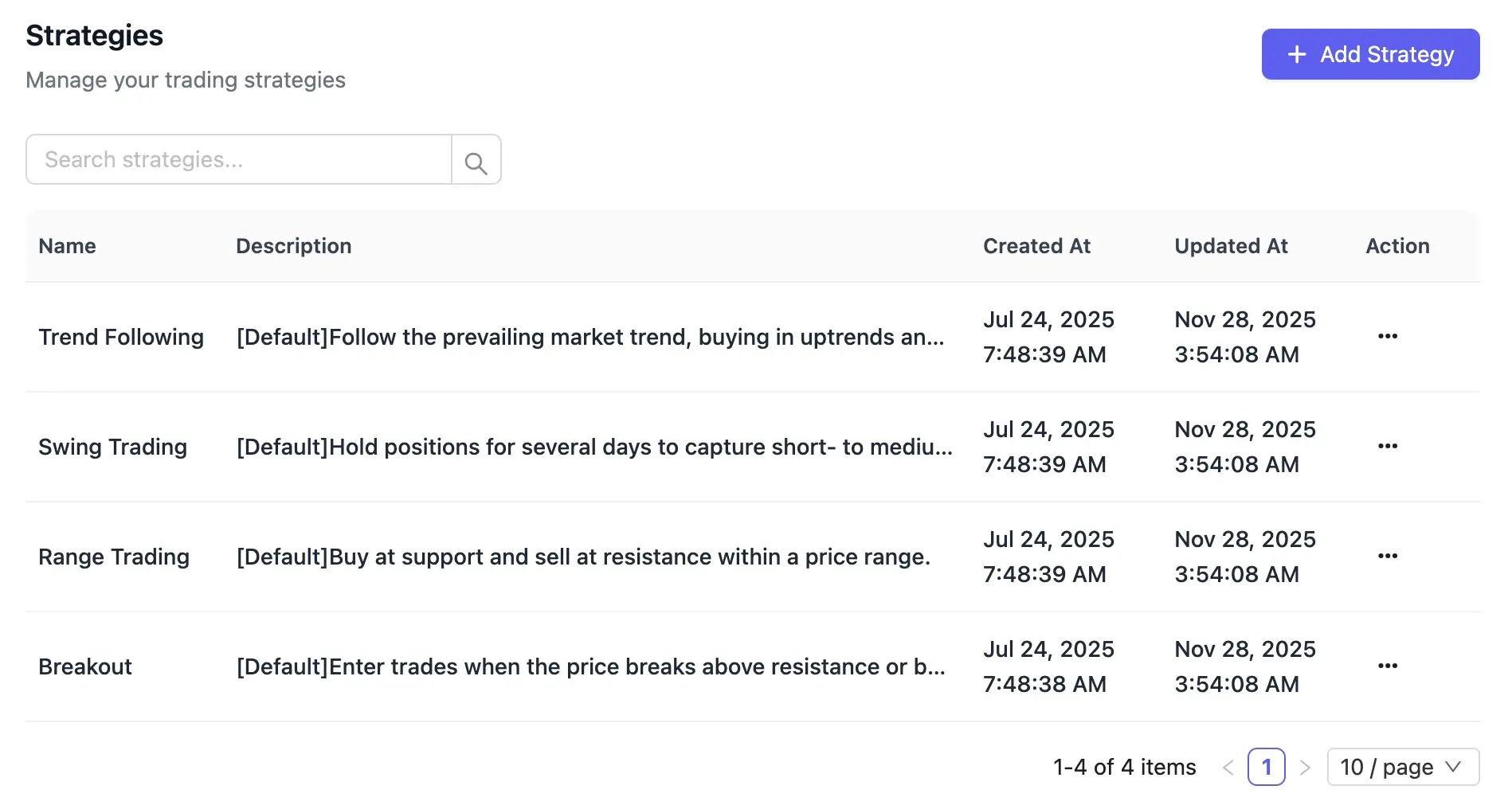

Compare strategies

FAQ

What is TradeBB?

TradeBB is an trading journal that imports your trades, tracks performance, and helps you trade better over time.

Who is it for?

Traders across stocks, options, futures, forex, and crypto—day, swing, and trend. Newer traders build discipline; experienced traders optimize strategy and risk.

How do I get started?

Create an account and set your timezone and base currency. Import your trade history via auto sync or file upload. After the first import, tag and organize trades by instrument, strategy, and setup. Then open the dashboard to review key metrics (P&L, win rate, profit factor, expectancy) and begin your review loop.

Do you support multi-account performance management?

Yes—across the platform. With MetaTrader (MT4/MT5), you can link multiple broker accounts for auto sync or import reports (CSV/HTML). TradeBB lets you switch by account and view segmented metrics (P&L, win rate, profit factor, expectancy, equity curves), see an aggregate portfolio view, and filter/compare by account, strategy, market, and instrument to analyze performance across dimensions.

Which brokers/platforms are supported?

Why should I use TradeBB instead of Excel?

Do you support institutional deployment and custom journals?

Yes. We offer dedicated/on‑prem or private cloud deployment. For customization, we provide bespoke trading journal modules, custom analytics/metrics, and API integrations with your broker/OMS/CRM. For scoping and deployment options, contact: support@tradebb.ai

How can I contact you if I have more questions?

If anything’s unclear or you need guidance using tradebb.ai, our team is here at support@tradebb.ai, and our community is open at https://www.tradebb.ai/community

How do you handle data security and privacy?

We use encryption in transit and at rest, role-based access controls, and strict data isolation. You can export or delete your data at any time. For enterprise, we support private cloud/on‑prem, SSO, and custom retention.Learn more: https://www.tradebb.ai/privacy-policy

Review better. Trade better.

Import your trades. Review what happened and why.